ADL 260 | Course Introduction and Application Information

| Course Name |

Banking Law

|

|

Code

|

Semester

|

Theory

(hour/week) |

Application/Lab

(hour/week) |

Local Credits

|

ECTS

|

|

ADL 260

|

Fall/Spring

|

2

|

0

|

2

|

3

|

| Prerequisites |

None

|

|||||

| Course Language |

Turkish

|

|||||

| Course Type |

Elective

|

|||||

| Course Level |

Short Cycle

|

|||||

| Mode of Delivery | - | |||||

| Teaching Methods and Techniques of the Course | - | |||||

| National Occupation Classification | - | |||||

| Course Coordinator | ||||||

| Course Lecturer(s) | ||||||

| Assistant(s) | - | |||||

| Course Objectives | One of the parties involved in "those with surplus funds" who use a certain percentage of that income savers; in the other, "which is in need of funds," ie, consumers or investors is located at the "financial system" created by the elements which has Relationship to each other and interact as a whole. "Transfer of funds" from savers to investors or consumers are fullfilled by the "financial intermediaries". One of the financial intermediaries is "banks" Concept of banks, structure of the system are examined at Law of Banking. However, a large part of the course constitutes the law of banking contracts. So that more funds from banks aggregating funds from depositors, investors or consumers who need the funds are transferred to the fund. Banks raises surplus funds from savers and transfer to the investors or consumers who are in need of funds. The first action is defined as "deposits" and the second case is called "loan". Starting with Law of Banking Contracts; the most popular operations -deposit and loan contracts-will be examined. Moreover, banking transactions such as transfers and letter of credits will be discussed in details. |

| Learning Outcomes |

The students who succeeded in this course;

|

| Course Description | Basic Problems of Banking Law |

| Related Sustainable Development Goals |

|

|

|

Core Courses | |

| Major Area Courses | ||

| Supportive Courses | ||

| Media and Management Skills Courses | ||

| Transferable Skill Courses |

WEEKLY SUBJECTS AND RELATED PREPARATION STUDIES

| Week | Subjects | Related Preparation |

| 1 | Fundamental Principles and Sources of Banking Law | Ünal Tekinalp, Bankacılık Hukukunun Temel Kavramları ve Kaynakları, Istanbul 2009, s. 1-10. |

| 2 | Banks and Types of Banks | Ünal Tekinalp, Bankacılık Hukukunun Temel Kavramları ve Kaynakları, Istanbul 2009, s. 11-32. |

| 3 | The Role and Importance of Central Bank in the Banking System | Ünal Tekinalp, Bankacılık Hukukunun Temel Kavramları ve Kaynakları, Istanbul 2009, s. 65-80. |

| 4 | Official Authorisation for Establishment and Activities of the Bank | Ünal Tekinalp, Bankacılık Hukukunun Temel Kavramları ve Kaynakları, Istanbul 2009, s. 135-146. |

| 5 | Regulation and Supervising Board of Banking | Ünal Tekinalp, Bankacılık Hukukunun Temel Kavramları ve Kaynakları, Istanbul 2009, s. 127-129. |

| 6 | Saving Deposit Insurance Fund | Ünal Tekinalp, Bankacılık Hukukunun Temel Kavramları ve Kaynakları, Istanbul 2009, s. 131-134. |

| 7 | Management And Independent Audit of Banks | Ünal Tekinalp, Bankacılık Hukukunun Temel Kavramları ve Kaynakları, Istanbul 2009, s. 167-193. |

| 8 | Mid-term exam | |

| 9 | Banking Contracts | Ünal Tekinalp, Bankacılık Hukukunun Temel Kavramları ve Kaynakları, Istanbul 2009, s. 357-409. |

| 10 | Credit Transactions | Ünal Tekinalp, Bankacılık Hukukunun Temel Kavramları ve Kaynakları, Istanbul 2009, s. 221-241. |

| 11 | Deposit Transactions I | Ünal Tekinalp, Bankacılık Hukukunun Temel Kavramları ve Kaynakları, Istanbul 2009, s. 243-245. |

| 12 | Deposit Transactions II | Ünal Tekinalp, Bankacılık Hukukunun Temel Kavramları ve Kaynakları, Istanbul 2009, s. 245-248. |

| 13 | Electronic Banking | Ünal Tekinalp, Bankacılık Hukukunun Temel Kavramları ve Kaynakları, Istanbul 2009, s. 667-676. |

| 14 | Bank Payment Transactions | Ünal Tekinalp, Bankacılık Hukukunun Temel Kavramları ve Kaynakları, Istanbul 2009, s. 547-594. |

| 15 | Review of the semester | |

| 16 | Final exam |

| Course Notes/Textbooks | Ünal Tekinalp, Banka Hukukunun Esasları, Yeniden Yazılmış 2. Bası, Vedat Kitapçılık, İstanbul 2009. |

| Suggested Readings/Materials | Aysel Gündoğdu; Bankacılık Hukuku 5. Baskı Seçkin Yayıncılık, Ankara, 2017. |

EVALUATION SYSTEM

| Semester Activities | Number | Weigthing |

| Participation | ||

| Laboratory / Application | ||

| Field Work | ||

| Quizzes / Studio Critiques | ||

| Portfolio | ||

| Homework / Assignments |

1

|

20

|

| Presentation / Jury | ||

| Project | ||

| Seminar / Workshop | ||

| Oral Exams | ||

| Midterm |

1

|

35

|

| Final Exam |

1

|

45

|

| Total |

| Weighting of Semester Activities on the Final Grade |

3

|

60

|

| Weighting of End-of-Semester Activities on the Final Grade |

1

|

40

|

| Total |

ECTS / WORKLOAD TABLE

| Semester Activities | Number | Duration (Hours) | Workload |

|---|---|---|---|

| Theoretical Course Hours (Including exam week: 16 x total hours) |

16

|

3

|

48

|

| Laboratory / Application Hours (Including exam week: '.16.' x total hours) |

16

|

0

|

|

| Study Hours Out of Class |

16

|

2

|

32

|

| Field Work |

0

|

||

| Quizzes / Studio Critiques |

0

|

||

| Portfolio |

0

|

||

| Homework / Assignments |

2

|

1

|

2

|

| Presentation / Jury |

0

|

||

| Project |

0

|

||

| Seminar / Workshop |

0

|

||

| Oral Exam |

0

|

||

| Midterms |

1

|

3

|

3

|

| Final Exam |

1

|

5

|

5

|

| Total |

90

|

COURSE LEARNING OUTCOMES AND PROGRAM QUALIFICATIONS RELATIONSHIP

|

#

|

Program Competencies/Outcomes |

* Contribution Level

|

|||||

|

1

|

2

|

3

|

4

|

5

|

|||

| 1 |

To be able to have knowledge about theories, concepts, methods and tools in the field of Justice services. |

-

|

-

|

-

|

X

|

-

|

|

| 2 |

To be able to explain basic theoretical and procedural knowledges in the field of Public and Private Law. |

-

|

-

|

-

|

X

|

-

|

|

| 3 |

To be able to have the basic and recent knowledge related with information technologies beside the field of Law. |

-

|

-

|

X

|

-

|

-

|

|

| 4 |

To be able to have knowledge about ethics, legislations, principles and corevalues required by the Justice Services. |

-

|

-

|

-

|

X

|

-

|

|

| 5 |

To be able to work efficiently and effectively in the field of Justice services as an individual and a teammember and as a responsible person. |

-

|

-

|

X

|

-

|

-

|

|

| 6 |

To be able to convey his/her theoretical knowledge in the field of Justice Services in written or orally. |

-

|

-

|

-

|

-

|

X

|

|

| 7 |

To be able to know the concepts of occupational safety, environmental protection and quality, and perform the requirements. |

-

|

-

|

-

|

-

|

-

|

|

| 8 |

To be able to communicate with his/her colleagues in written and orally about the law issues in Turkish and in English as stipulated. |

-

|

-

|

-

|

X

|

-

|

|

| 9 |

To be able to use the basic knowledge and skills required by the justice services for lifetime. |

-

|

-

|

-

|

X

|

-

|

|

| 10 |

To be able to understand and practice the legal decisions and regulations required by the Justice Services. |

-

|

-

|

-

|

-

|

X

|

|

| 11 |

To be able to follow the current developments in the field of Law and Justice by using English in the European Language Portfolio A2 Level. |

-

|

-

|

-

|

-

|

-

|

|

*1 Lowest, 2 Low, 3 Average, 4 High, 5 Highest

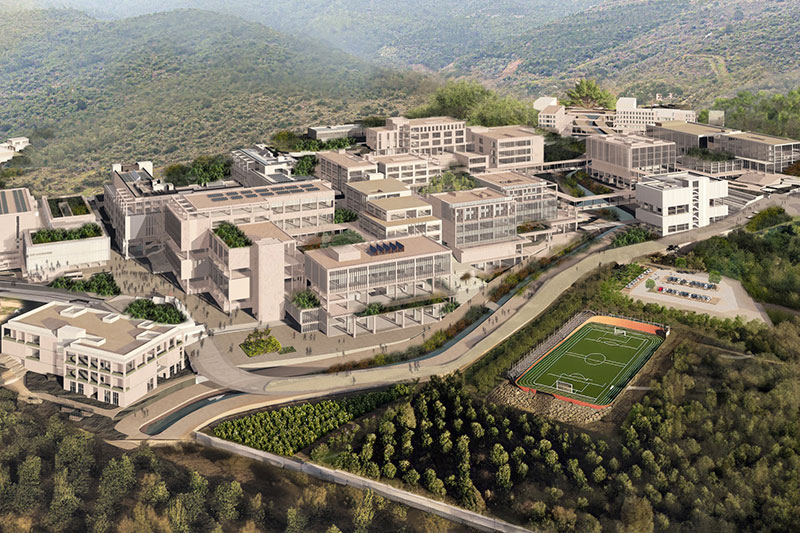

IZMIR UNIVERSITY OF ECONOMICS GÜZELBAHÇE CAMPUS

DetailsGLOBAL CAREER

As Izmir University of Economics transforms into a world-class university, it also raises successful young people with global competence.

More..CONTRIBUTION TO SCIENCE

Izmir University of Economics produces qualified knowledge and competent technologies.

More..VALUING PEOPLE

Izmir University of Economics sees producing social benefit as its reason for existence.

More..